The construction industry starts the economy again

The figures reported by the construction industry for 2020 and its prospects for the near future

The construction industry has experienced several downturns and recoveries in recent years: from the real estate crash in 2008 to the recovery of the last decade, followed by the economic effects of the 2020 pandemic, itself followed a strong upturn in the second half of the year, although the future is still anything but certain. This article looks at the figures reported by the construction industry for 2020 and its prospects for the near future, based on the most recent report published by CRESME (market research and service centre for the construction industry), as well as looking at the principal trends in the international market.

The world construction industry

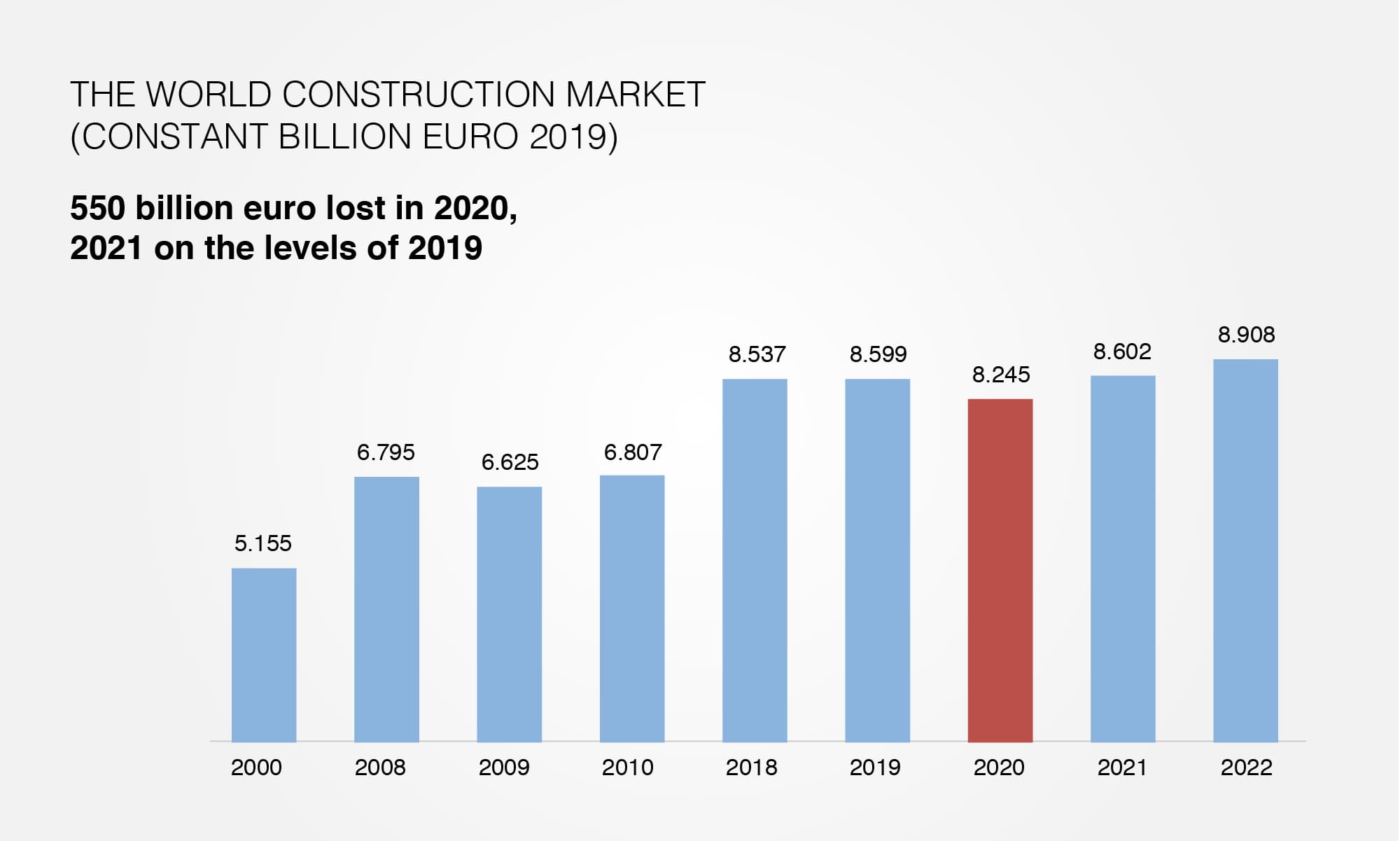

The pandemic reduced global GDP by 3.5% in 2020, with a 9.6% downturn in trade. As for the construction market, last year saw losses amounting to 550 bn euro, but forecasts for 2021 are optimistic and a recent study predicts a return to 2019 levels, for a total estimated construction market value of 8,602 bn euro by the end of the year.

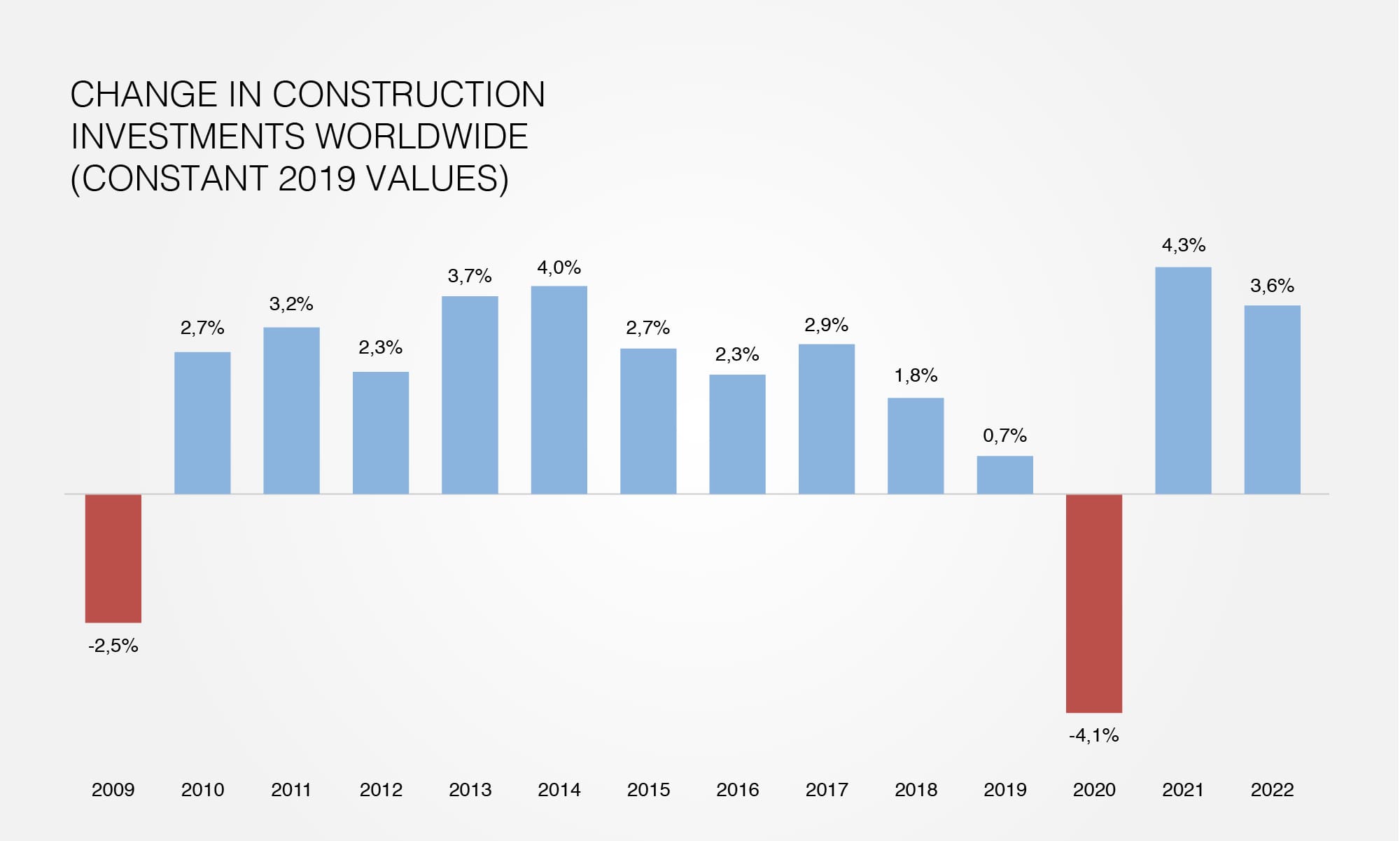

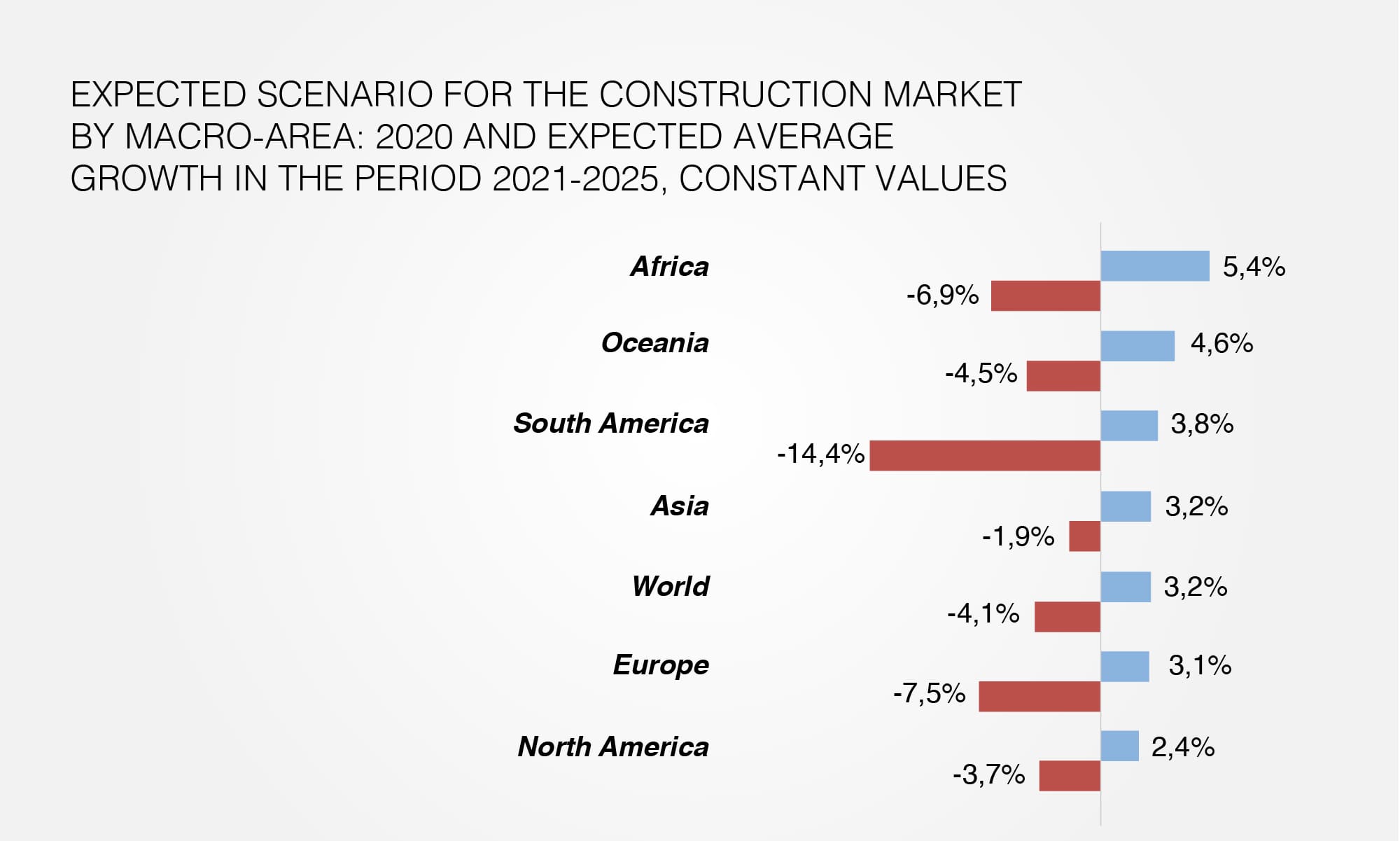

The pandemic had a devastating impact on the markets in 2020. Global investments in construction had already registered a slight downturn in 2019 (a reduction from +1.8% growth to +0.7%), but they reached -4.1% in 2020. The situation is thus even darker than 2008, but a strong upturn is expected, as much as +4.3% this year. In the analysis by economic areas, South America was worst hit by the downturn in investment, registering -14.4% in 2020, followed by Europe (-7.5%), Africa (-6.9%), Oceania (-4.5%) North America (-3.7%) and Asia (-1.9%).

It is estimated that over the period 2021-2025, the construction sector will grow by an average +3.2 % per year. According to the forecasts, Africa will grow by an average +5.4%, while South America will only partly recover, reaching +3.6% in 2025. Europe and North America will also fail to recover their losses entirely, registering +3.1% and +2.4% respectively. The recovery of the American market will be driven primarily by the investments already partly put in place by the previous administration. Asia has a more positive outlook, on the other hand, with a forecast +3.2% in five years. China - the largest world construction market - takes the lion's share in the area, having registered just -0.2% in 2020, and is forecast to grow by +5.7% this year alone, as one of the main producers of raw materials, including steel, demand for which is growing strongly.

Variations in the value of construction in the main EU countries and the UK

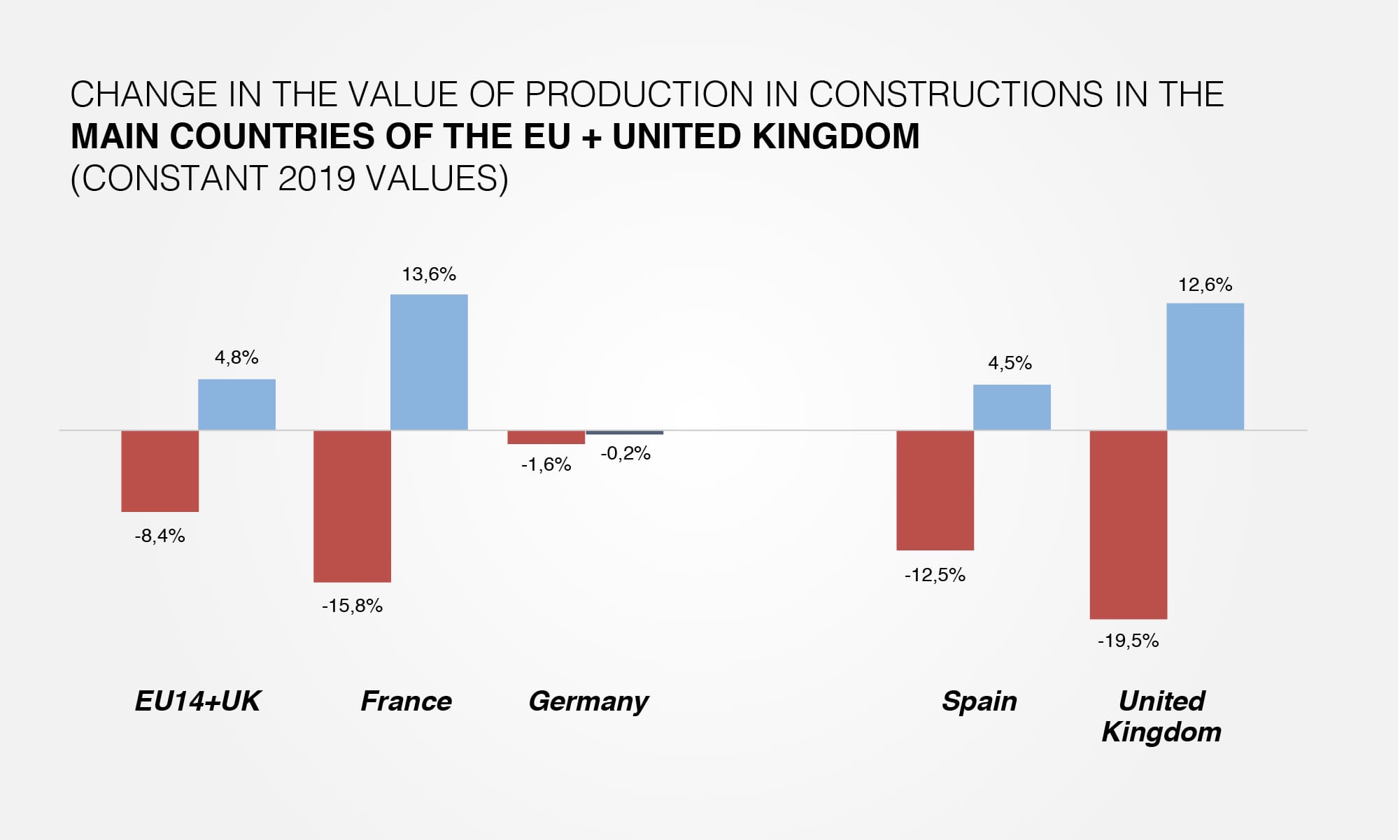

The construction markets of EU countries and the UK registered a downturn of -8.4% in 2020, and current forecasts are predicting that 2021 will close with growth of +4.8%. However, it is important to note that these markets are very far from all being the same.

For instance Germany, whose construction market lost considerably less in 2020 than other countries in its area (-1.6%), will nonetheless remain in the negative in 2021 (‑0.2%). France and the UK, after a drastic downturn (-15.8% and -19.5% respectively), made all the worse in the case of the UK by Brexit, now both have excellent prospects for recovery, at +13.6% and +12.6% respectively. Spain will see somewhat slower growth, after the -12.5% of 2020, forecast at +4.5% for 2021.

Finally, the Italian market, following the collapse of the sixth construction cycle in 2014, registered a period of growth and consolidation lasting up to 2020, saw a vertiginous downturn of -7.4%. But the forecasts are positive: by end 2020 the country should register better results than those for 2019, an upturn of +5.2%, driven by investments in public works, transportation and the upgrading of its existing construction assets.

Challenges for the future

Overall, the construction industry is proving to be among the most dynamic in responding to the global situation, and is looking to be the motor for economic recovery in the post-COVID period. What are the conditions and factors to be borne in mind if the industry is to recover and sustain a new period of growth in the global economy? There are two key concepts: sustainability and technological innovation.

Sustainability

Nowadays, beauty has transcended its purely aesthetic meaning to include the values of environmental and social sustainability. This new sensibility, correlated to European policy and the measures and incentives enacted by the individual member states, will guide the industry in coming years, contributing to the creation of construction paradigms which will shape the spaces of the future, making the bonds between nature, architecture and a reduced carbon footprint stronger than ever.

The EU has responded to the pandemic with Next Generation EU (NGEU), an instrument of unprecedented scope and ambition, amounting to 750 bn euro, enacted by the EU in July 2020. The heart of NGEU is the Recovery and Resilience Facility, the fund of 672.5 bn euro designed to support member states in the ecological and digital transitions required to make their economies more sustainable and resilient. The member states have accordingly set out, in their national recovery and resilience plans, programmes for reform and investment up to 2026, with a coherent package of projects, reforms and investments which also touch on the construction industry.

What is more, the European Commission has recently published a preliminary analysis of the member states' long term renovation plans, which set out clear plans up to 2050 to support upgrading their real estate assets with a view to high energy efficiency and a low carbon footprint. These plans also contribute significantly to the Renovation Wave initiative announced as part of the Green Deal, the objective of which is to take concrete action to create the conditions required to intensify renovation work and double the rate of existing building retrofits, which is currently at 1%.

In detail, the EU's real estate assets account for around 40% of the 27 member states' total energy consumption, and 36% of greenhouse gas emissions. The renovation is thus necessary, not only in the interests of energy efficiency but also to combat energy poverty, since almost 34 million EU citizens cannot afford to adequately heat their homes.

Raw materials

The industry's fast growth and the amount of demand are deeply out of balance with the production capacity of the value chain. The considerable changes in import-export relationships worldwide, and the slowdown in filling orders, partly due to the difficulties attendant on new ways of working dictated by COVID regulations, combined with international speculation, are driving up the cost of raw materials overall (including metals, insulation materials, wood, mortar, adhesives and heavy clay), as well as that of transportation.

In recent months, prices have been growing by double digits, far beyond normal market oscillations, compromising the progress of existing projects and those still at the contract stage, and incurring the risk of disproportionate and uncontrolled inflation. If this trend does not reverse quickly, the consequences could serious affect the entire economy.

Technological innovation

The technological revolution that has long been under way in other industries is finally affecting the construction industry as a whole. For instance, BIM, Building Information Modelling, is increasingly a focus of attention for the industry. The benefits of being able to create a 3D digital model of a building are innumerable, including simplified collaboration between the stakeholders (architects, engineers and contractors) throughout the design and construction process, thus considerably facilitating scheduling and budget management. Another striking innovation is the Digital Twin of the building, which offers a real time representation of a building and its systems and subsystems, including their status and how their functioning is affected by the presence and behaviour of its occupants. Technological innovation is also playing a critical role in the construction of smart buildings.

We are going through a period of radical change in our customs and lifestyles and the ways we work, make and move. The home, the office and urban infrastructure are key factors in this transformation, and it is they that will form the pillars of the "new normal". The challenge for players in the construction and architecture industries is to bring together the best know-how, innovation and professionalism to play a leading role in the relaunching of the economy.